Sport is the last fortress of live, linear content. Billions still tune in for the biggest moments, yet sports media rights are stagnating because they’re not thinking enough about fan engagement.

The Premier League’s domestic media rights have evened off at €1.75 billion annually for three consecutive cycles. So if even premium properties can’t grow, what does that mean for everyone else?

The sports media market is polarised into winners and the squeezed middle. But the war for attention impacts everyone. Here’s what’s really happening, and three ways to fight back.

1. The media rights plateau: Even the giants are stuck

The numbers tell a sobering story:

- Premier League domestic rights are €1.75 billion per year. It’s a huge number, but it’s been at the same level for three cycles.

- Serie A is reported to be €900 million annually, down 3% from the previous deal

- Ligue 1’s DAZN deal collapsed after one season, forcing the league to launch its own D2C platform

Record audiences aren’t converting into record revenue. The Spain vs England Euro 2024 final drew 19.8 million viewers, yet broadcasters aren’t bidding up the next cycle.

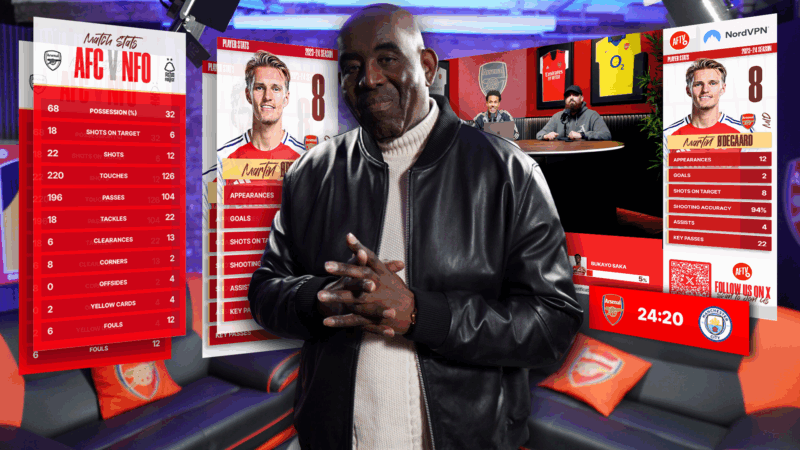

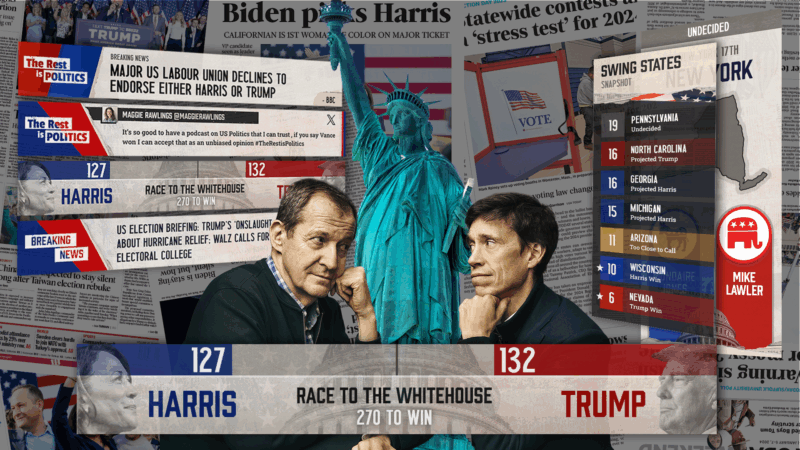

Why? The broadcast model is being bypassed. Broadcast TV viewing declined sharply in 2023, instead 16-34 year-olds now watch 18 minutes of YouTube per day on their TVs. Fans haven’t abandoned live sport, they’ve just found cheaper, more engaging alternatives through creators who incorporate fan engagement into their content.

2. Fans are hacking their own experiences.

Cost-of-living pressures and subscription fatigue have changed behaviour. Instead of paying for multiple platforms, fans are turning to:

- Creator-led commentary – Real-time reactions and analysis from trusted voices

- Alternative viewing parties – Community-driven streams that feel more social

- Highlight culture – Consuming the best moments without committing hours

Fan engagement isn’t piracy. It’s audiences curating personalised experiences to suit their budgets and attention. Right now, traditional broadcasters have been slow to come up with an answer for it.

3. The winners are the ones who own content AND distribution.

The DAZN broadcast deal collapsed in May 2024 when they failed to complete with Ligue 1. It was the first sign of things to come.

Ligue 1 subsequently launched Ligue 1+, their own direct-to-consumer streaming platform, in August 2024 as an act of survival. Within just one month, they hit 1 million+ subscribers and opened the future playbook. With projections to reach 1.5 million subscribers by season’s end. The league is now targeting 2.25 million subscribers by 2029.

The leagues that escape the squeeze won’t just sell rights, they’ll control distribution via their owned channels.

This means:

- Building direct-to-consumer platforms that turn viewers into known fans

- Creating engagement infrastructure—polls, predictions, community features

- Proving value to sponsors through first-party data, not just broadcast impressions

Rights deals aren’t dead. But relying on them alone is becoming riskier every cycle..

The shift is here. Are you ready?

Sport still commands global attention. But are you building the infrastructure to own it, or clinging on to the old model for another cycle?

The attention shift is real. Huge audiences are still watching, they’re just not always watching you.

In our The Great Attention Shift Report we examine what engagement infrastructure looks like, and how to turn attention into loyalty before your next rights negotiation. Download the report here to discover how sports organisations are adapting to the new ways of watching.